The rise and fall of the British supermarket

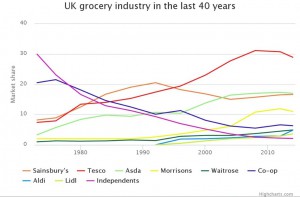

Data released after the 12 week Christmas period confirms that British supermarket Tesco remains the market leader for groceries. The company is followed by Asda, Sainsbury’s and Morrisons despite discounters Lidl and Aldi doubling their market share in the last 3 years. According to a graph provided by The Telegraph in one article, Tesco is still far larger than any other grocery retailer has been in the last 40 years.

The impact of Christmas

Last week, Morrisons reported that like-for-like sales over the nine weeks leading to 3rd January 2016, in stores open for more than a year, were up 0.2 per cent. Analysts had predicted a fall of between 2-3 per cent for Morrisons, as the company are in the middle of executing a turnaround plan which include numerous store closures and extensive price cuts.

Sales also rose prominently at the discount stores Aldi and Lidl but it was only Sainsbury’s who saw an increase in market share during the same period. The ‘top four’ British supermarkets witnessed a rise from 0.1 per cent to 17 per cent.

Industry data published last week showed Asda was the worst performer of the big four British supermarket chains over the Christmas period, with its sales falling 3.5 percent year-on-year over the 12 weeks to 3rd January and its market share dipping 0.6 percentage points to 16.2 percent.

The rise of discount stores

The discount stores have gradually been eating their way into the market share of the bigger supermarkets which has provoked a huge price battle between the top four chains. Aldi’s sales rose by 16.5% in quarter 3 of 2015 and Lidl’s increased by 1.7%. In comparison, Tesco fell 2.5% from the year earlier and Morrisons dropped 1.7%.

Fraser McKevitt, head of retail and consumer insight at Kantar Worldpanel, said: “The discounters show no sign of stopping and with plans to open hundreds of stores between them, they’ll noticeably widen their reach to the British population.”

The big four fight back

Even though the discount stores are causing panic to the big four, the top British supermarket chains are showing signs of getting to grips with the “new market”. Tesco, Asda, Sainsbury’s and Morrisons are still in the lead with Sainsbury’s winning market share during the Christmas period and Morrisons delivery of a surprise rise in underlying sales.

Monthly data from market researcher Kantar Wordpanel, released on 12th January 2016, showed that even though Tesco is losing share there has been an improvement from the previous month. Analysts believe that the bigger British supermarket chains will make a comeback in 2016 and are closing the pricing gap between themselves and the discount stores, as well as improving product availability and online services.