USP London: London South Bank Office Market Q2 2024 Update

In their latest report USP London find that the South Bank leasing market continues with prime locations driving demand and within this “best in class” category rents increasing. The average deal size for the quarter was 5,120 sq. ft with rents of more than £100 per sq. ft being achieved in some “trophy” buildings.

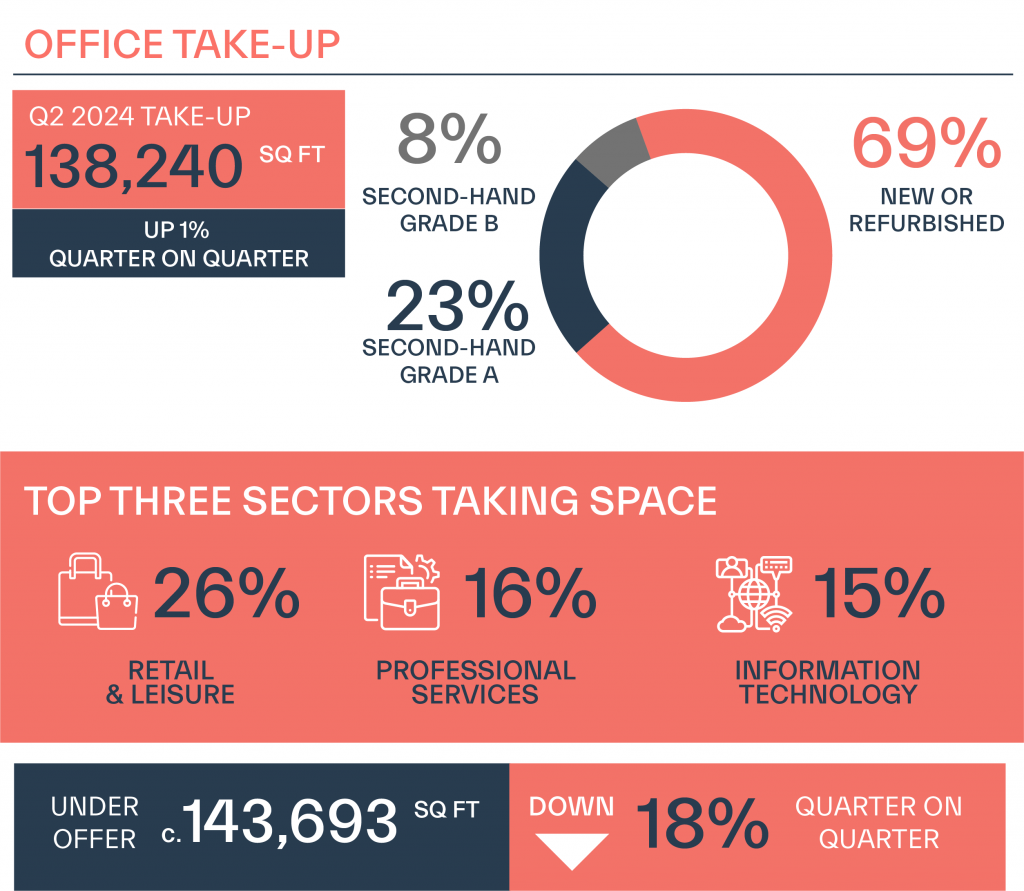

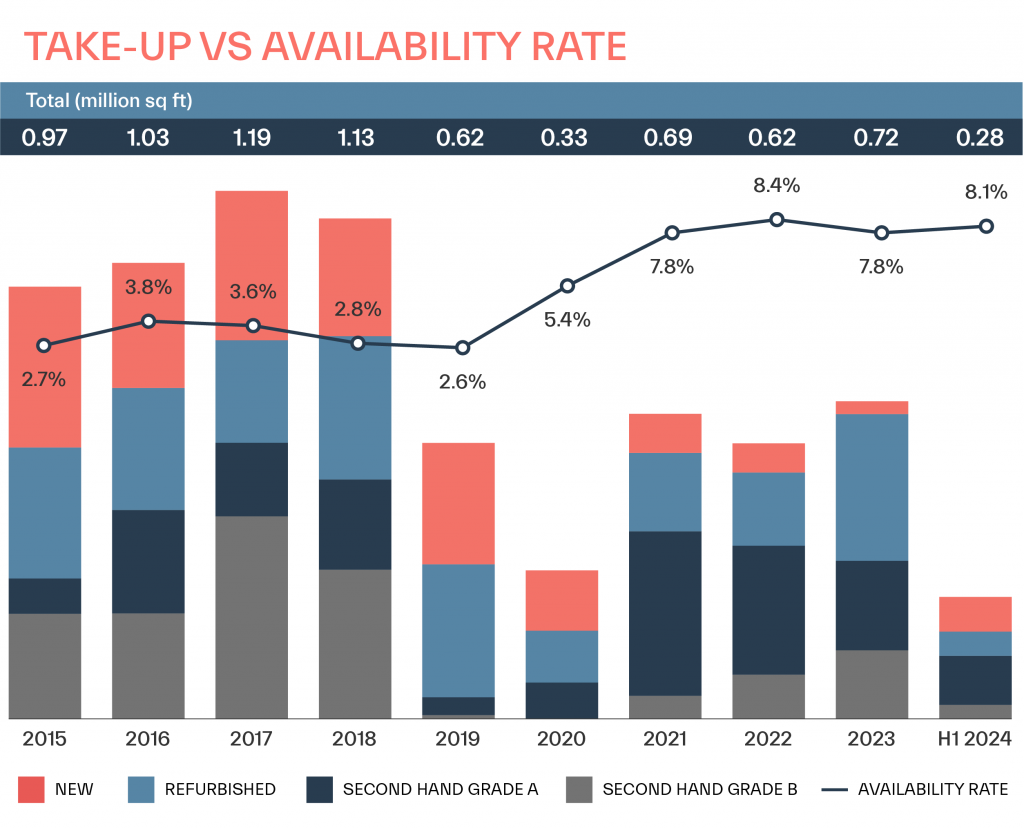

The following chart reveals how overall take up has increased by 1% quarter on quarter, although the half year mark represents a below average performance.

There is good demand for high quality space with excellent amenity in prime South Bank locations. Most deals for these “best in class” schemes are being agreed either once developments/refurbishments have been completed or are close to completing. There has been limited pre-letting activity.

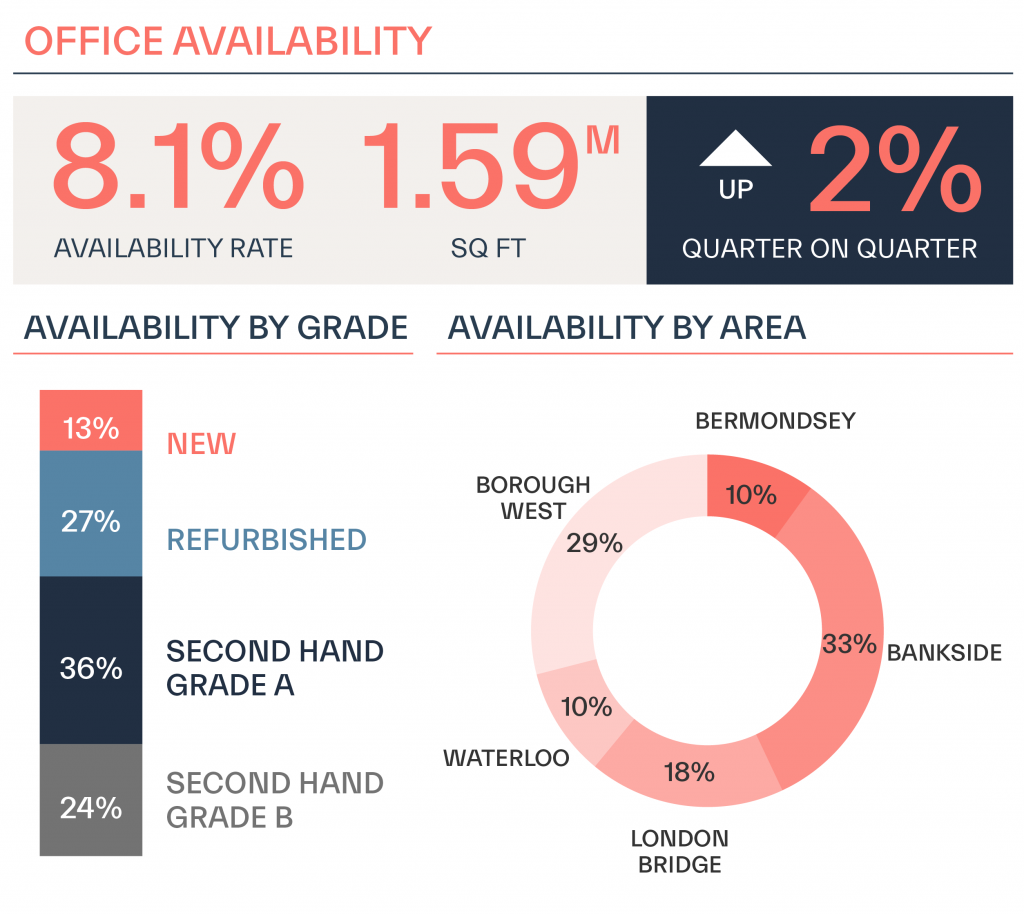

Availability levels have remained unchanged quarter on quarter with the vacancy rate remaining at 8.1%.

The quarter’s most significant transactions occurred at Arbor, 245 Blackfriars Road, which finished construction at the end of 2022. Since then, it has seen consistent leasing activity, with Wipro and Flutter Entertainment occupying 47,000 sq. ft collectively, leaving only a third of the space available for lease. The top floor rental rates surpassed £100 per sq. ft, setting new records in SE1. Meanwhile, properties in secondary locations remain challenging.

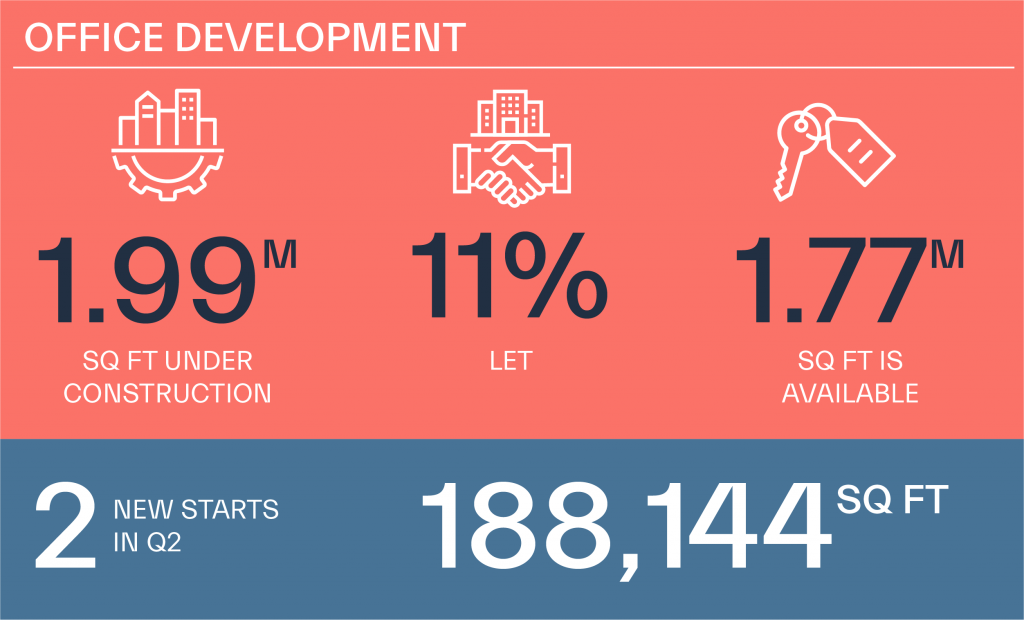

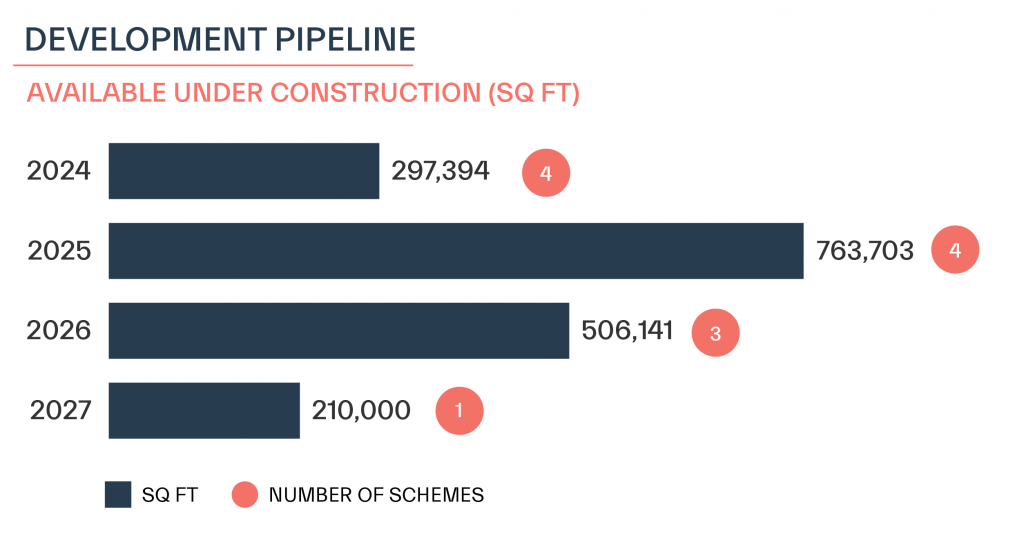

This quarter has also seen the commencement of two new office developments. This progress helps address the area’s development shortage, though there is still a scarcity of floor plates over 20,000 sq. ft.

In the second half of the year, four projects will be completed, While the number of ongoing projects remains low, the amount of space being delivered appears robust, with several large developments contributing significantly to the total.

For further information or more views on the current market you can contact Ann Ibraham or Ben Fisher.

You can see all the available commercial property listed by USP London on NovaLoca here.